What is the difference between an RESP, a TFSA and an RRSP?

(Updated―1st published February 23, 2021)

We’re not talking about cars here, but savings! Like cars, every savings vehicle has very different characteristics. What you want to transport (type of investment), the road used (investment horizon), the destination (short-term projects, retirement, school, etc.), and features (tax treatment, special characteristics, etc.) are all factors that influence your choice of vehicle. More precisely, it’s the combination of these characteristics and needs that guides the decision-making.

RESP, RRSP or TFSA... Which Vehicule Should You Use?

RESPs: Investing in a child's future

The RESP (Registered Education Savings Plan) is a way to save for a child’s post-secondary education. Contributions aren’t tax deductible but are supplemented by government grants.1 Earnings and grants are taxed in the beneficiary’s hands when withdrawn, while the amounts corresponding to the contributions aren’t taxable and can be refunded to the subscriber.

- An RESP can have more than one beneficiary.2 In addition, subscribers can be the child’s family members or friends.

- The federal and provincial governments provide grants to support you in your RESP savings. The Quebec government provides the Quebec Education Savings Incentive (QESI), while the federal government provides the Canada Education Savings Grant. For families whose income is below a certain threshold, the grants rise to a maximum of 60% of the amount invested. The Canada Learning Bond is also available to lower-income families.3

Kaleido is here to help you with your education savings project!

RRSPs: Planning for retirement while saving on taxes

The RRSP (Registered Retirement Savings Plan) is a way to save for retirement while lowering your income tax during the contribution period. Funds are taxable only when withdrawn.

- You can open a spousal RRSP to contribute for your spouse’s retirement. It’s the subscriber’s contribution room that is used, not the beneficiary’s.

- Contributing to an RRSP allows you to participate in the Home Buyers’ Plan (HBP) and the Lifelong Learning Plan (LLP).

TFSA: A tax shelter for saving

The TFSA (Tax-Free Savings Account) is a way to save tax-free. Contributions aren’t tax deductible, but withdrawals and investment income aren’t taxable.

- Contributions made into a TFSA are limited to your contribution room, which accumulates every year. For 2023, the contribution limit is set at $6,500.

- In 2023, a person born after 1991 who never contributed to a TFSA could invest $88,000.

In all cases, keep in mind your situation is unique! So, it’s essential you see the right financial advisor before making any decision regarding your savings.

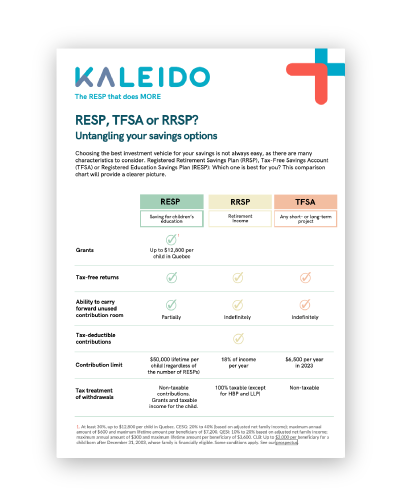

To quickly differentiate the various savings vehicles and their differences, download our fact sheet. Stick it on your fridge!

1. Subject to obtaining the necessary authorizations to proceed with the grant applications. Some conditions apply. Check out our prospectus at kaleido.ca.

2. Family plan; not offered by Kaleido.

3. Canada Education Savings Grant (CESG) of 20% to 40%. Based on adjusted family net income. Quebec Education Savings Incentive (QESI) of 10% to 20%. Based on adjusted family net income. Some conditions apply. Check out our prospectus at kaleido.ca.